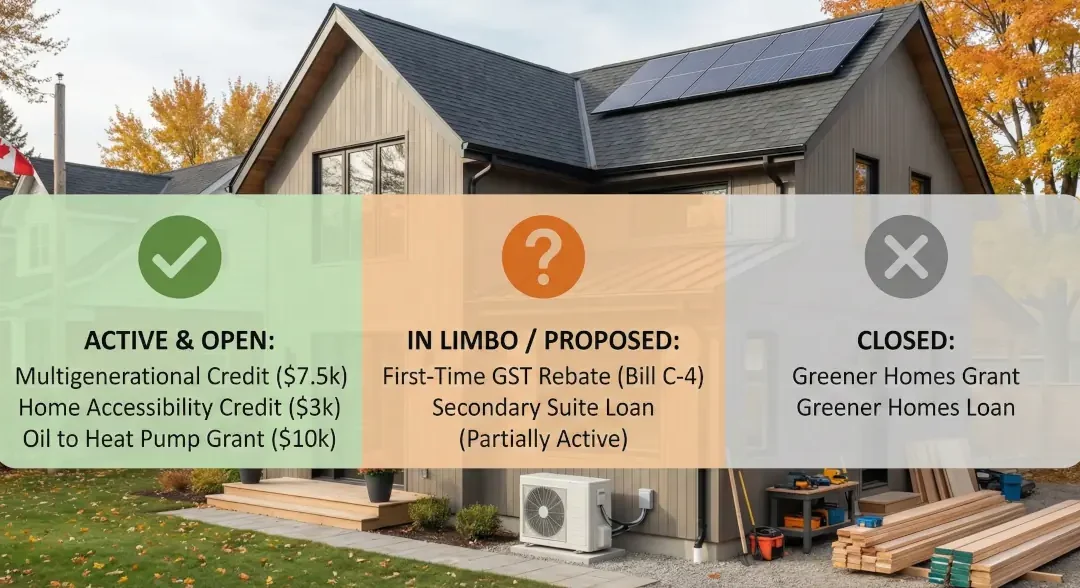

If you are reading headlines about federal housing money, you might be confused. “Grants are closed,” “Loans are doubling,” “GST is cut”—it is hard to know what is a law, what is a proposal, and what is already gone.

As of November 2025, the landscape has shifted significantly. The “free money” era of the basic Greener Homes Grant is over, replaced by more targeted, complex programs. Here is the no-nonsense status check on every major federal credit available to Canadian homeowners and builders right now.

1. The “In Limbo” List (Proceed with Caution)

Big announcements were made this year, but some are not yet fully “live” or signed into law. Do not budget for these checks just yet.

The First-Time Home Buyer GST Rebate (Bill C-4)

- The Promise: A complete removal of the GST on new homes valued up to $1 million for first-time buyers (with a partial rebate up to $1.5M).

- The Status: PROPOSED (Not yet passed).

As of late 2025, Bill C-4 is still winding its way through Parliament. While the legislation says it will be “deemed into force” retroactively to May 27, 2025, it has not received Royal Assent. - The Risk: If you buy today expecting this rebate, you are technically gambling on the bill passing in its current form.

The Canada Secondary Suite Loan ($40k – $80k)

- The Promise: Low-interest loans (capped at 2%) to build rental suites, garden suites, or laneway homes.

- The Status: PARTIALLY ACTIVE.

While the mortgage refinancing rules changed in January 2025 to allow you to borrow more against your home for this purpose (up to 90% loan-to-value), the direct, low-interest loan application portal has faced delays. - The Advice: You can currently finance a suite through your bank using the new mortgage insurance rules, but the specific government-direct low-interest loan program is difficult to access directly without a participating lender.

2. The “Active & Open” List (Apply Now)

These programs are fully operational, funded, and accepting applications.

Multigenerational Home Renovation Tax Credit (MHRTC)

- What it is: A refundable tax credit to build a self-contained suite for a senior (65+) or an adult with a disability to live with you.

- The Value: You can claim 15% of up to $50,000 in renovation costs.

- Max Payout: $7,500 (claimed on your tax return).

- Key Detail: Unlike the “Secondary Suite Loan,” this is a tax credit, not a loan. The suite must be for a relative, not just a general tenant.

Home Accessibility Tax Credit (HATC)

- What it is: Funding for smaller renovations to improve safety or access (ramps, grab bars, walk-in tubs) for seniors or those with disabilities.

- The Value: You can claim 15% of up to $20,000 in expenses.

- Max Payout: $3,000.

- Pro Tip: You can often “stack” this with the MHRTC if the renovation meets the criteria for both.

Oil to Heat Pump Affordability (OHPA)

- What it is: An upfront grant to help homeowners switch from oil heating to a heat pump.

- The Value: Up to $10,000 (upfront payment).

- Eligibility: This is income-tested (median household income or below). While uptake in BC has been lower than in the Maritimes (due to less oil usage), if you are one of the few still on oil, this is the most generous “free money” program currently running.

GST Removal on Purpose-Built Rentals

- Target Audience: Developers / Investors.

- What it is: A 100% rebate on the GST for new apartment buildings, student housing, and senior residences.

- The Status: ACTIVE. This is fully in force for projects that began construction after September 14, 2023.

3. The “Closed” List (Stop Looking)

Don’t waste time searching for these—they are effectively done for new applicants.

- Canada Greener Homes Grant: Closed to new applicants in February 2024.

- Canada Greener Homes Loan ($40k): Closed to new applications as of October 2025.

4. What’s Coming Next? (The “Affordability” Pivot)

The federal government has launched the successor to the Greener Homes Grant: the Canada Greener Homes Affordability Program (CGHAP).

- The Shift: Unlike the old grant (which required you to pay upfront and wait for a rebate), this new program is “direct install,” meaning the government pays the contractor directly for upgrades.

- The Catch: It is strictly for low-to-median income households.

- BC Status: As of November 2025, this has launched in Manitoba, but a specific BC agreement is still being finalized. In the meantime, BC residents should look to the provincial “Energy Savings Program” which mirrors this model.

Strategic Takeaway: If you are planning a renovation in 2026, rely on the tax credits (MHRTC/HATC) which are stable. Be very cautious about budgeting for the First-Time Buyer GST Rebate or Secondary Suite Loan until they are fully codified and accessible.

For more information and help with planning your new home or new renovation project, Book A Consultation with us today.